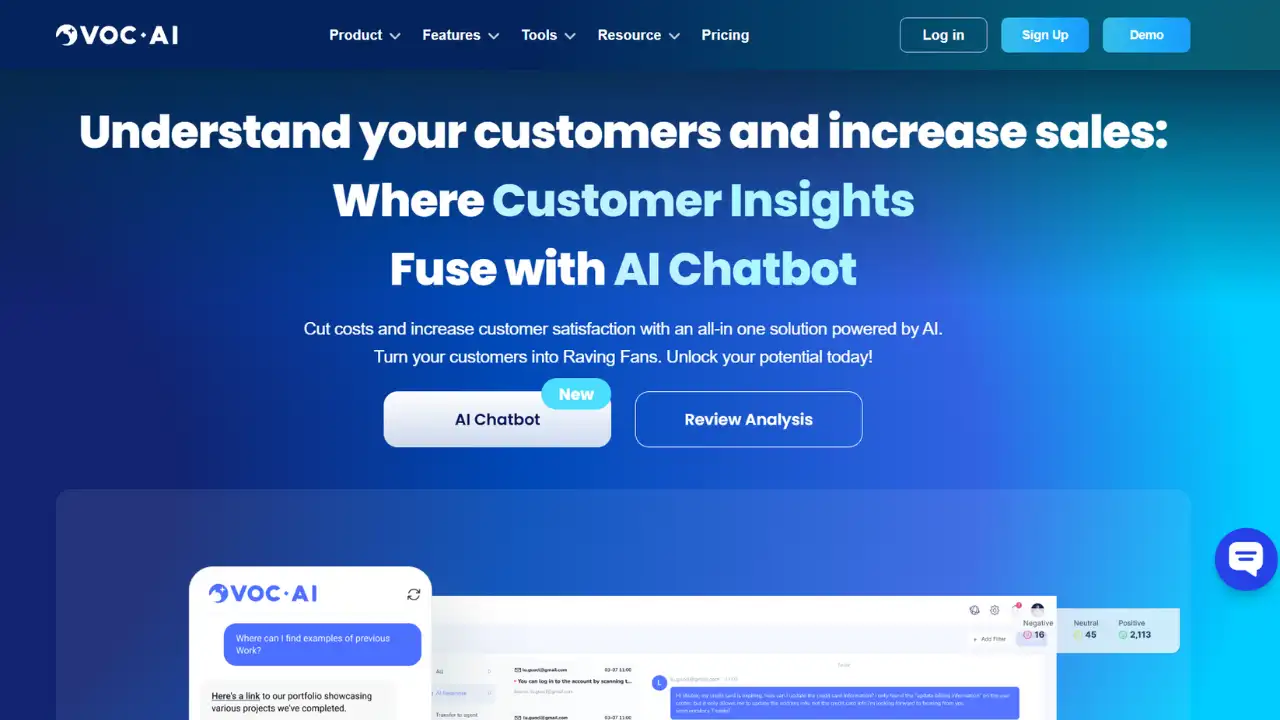

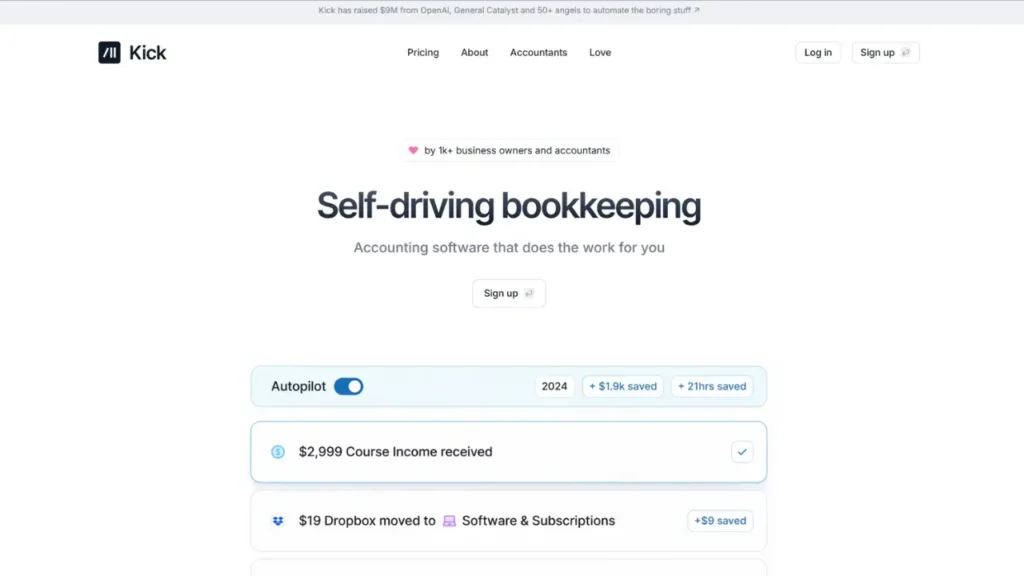

Gone are the days when bookkeeping was a mind-numbing chore that ate up your precious time. Enter Kick, the self-driving bookkeeping solution that’s turning heads in the world of finance. This isn’t just another accounting software – it’s your personal financial co-pilot, ready to take the wheel and navigate the complex terrain of business finances.

Kick has raised a cool $9 million from heavy hitters like OpenAI and General Catalyst, plus a squad of 50+ angel investors. Why? Because they’re on a mission to automate the boring stuff and let you focus on what really matters – growing your business.

Tool type and pricing:

Kick offers a freemium model, allowing users to start with basic features at no cost. While the exact pricing for premium features isn’t specified on the scraped content, they do offer a “Start Free” option, suggesting a tiered pricing structure. For the most up-to-date pricing information, it’s best to check directly with Kick.

Key features of the tool:

# Autopilot for Your Books

## Real-Time Auto-Categorization

Kick doesn’t just record your transactions; it categorizes them on the fly. And it’s not just AI doing the heavy lifting – your entries get a once-over from a human expert, ensuring pinpoint accuracy.

## Deduction Detective

Say goodbye to missed tax write-offs. Kick is like a bloodhound for deductions, sniffing out everything from your home office expenses to vehicle costs and travel expenditures. It’s got your back when it comes to maximizing those tax savings.

## Custom Rules Engine

Your business is unique, and Kick gets that. Tailor the system with custom rules that fit your specific business needs and personal preferences. It’s like having a bookkeeper who reads your mind.

# Financial Insights at Your Fingertips

## Revenue Breakdown

Create custom revenue streams and watch as Kick breaks down your income sources month by month. It’s like having x-ray vision for your cash flow.

## Expense Monitoring

Kick helps you keep a tight leash on your spending. Get monthly breakdowns by vendor across all your accounts or businesses. It’s your personal spending watchdog.

## Multi-Entity Management

Got more than one business? No sweat. Kick handles unlimited entities at no extra cost, giving you a bird’s-eye view of your entire business empire.

# Accountant’s Best Friend

## Dual-Entry Accounting

Kick speaks fluent accountant. With its dual-entry system, it’s built to play nice with your tax advisor or CPA.

## Lightning-Fast General Ledger

Create multi-entity journal entries that always balance, and do it at the speed of light. It’s like upgrading your ledger from a bicycle to a rocket ship.

## Tax-Ready Financials

Generate Profit & Loss statements and Balance Sheets that are ready to share with your accountant. No more scrambling come tax season.

## Intercompany Wizardry

Handling multiple entities? Kick automatically accounts for intercompany receivables, payables, and other transfers. It’s like having a financial juggler keeping all your balls in the air.

Users who can benefit:

# Who’s Kick For?

## The Time-Strapped Entrepreneur

If you’re a business owner who’d rather focus on strategy than spreadsheets, Kick is your new best friend. It frees up your time so you can work on your business, not in it.

## The Growth-Focused Startup

For startups looking to scale without drowning in financial admin, Kick provides the insights and automation needed to make data-driven decisions.

## The Multi-Entity Mogul

Managing multiple businesses? Kick’s unlimited entity feature lets you keep tabs on your entire portfolio without breaking a sweat.

## The Forward-Thinking Accountant

CPAs and tax advisors who want to offer more value to their clients will love Kick’s accountant-friendly features and collaborative approach.

## The Solopreneur Superhero

Freelancers and solo business owners can use Kick to punch above their weight, getting enterprise-level financial management without enterprise-level complexity.

Why should we use the tool:

The sort of thing I love about Kick is how it transforms bookkeeping from a necessary evil into a strategic advantage. Here’s why you should jump on the Kick bandwagon:

- Time is money, and Kick saves you both. With automated categorization and custom rules, you’ll spend less time on data entry and more time on business growth.

- It’s like having a financial advisor on speed dial. Real-time insights help you make smarter decisions faster.

- Tax season becomes less taxing. With all your deductions tracked and financials tax-ready, you’ll breeze through April 15th (or whatever your deadline is).

- It grows with you. Whether you’re a solopreneur or managing multiple entities, Kick scales to fit your needs without breaking the bank.

- It’s accountant-approved. Kick plays well with the pros, making collaboration with your financial team smoother than ever.

How to use the tool:

- Sign up for an account on Kick’s website.

- Connect your bank accounts and credit cards to start the automatic import of transactions.

- Set up custom rules for categorization based on your business needs.

- Review and approve the AI-suggested categorizations.

- Explore the dashboard for real-time financial insights.

- Generate reports as needed for your accountant or financial planning.

- Use the mobile app to stay on top of your finances on the go.

- Regularly review and adjust your custom rules to improve accuracy over time.

Conclusion:

Kick is not just another bookkeeping tool; it’s a financial co-pilot for the modern entrepreneur. By automating the tedious aspects of accounting, it frees you to focus on what you do best – running and growing your business. The combination of AI-powered automation and human expertise sets Kick apart in a crowded field of financial software.

While there may be a slight learning curve and some potential for AI hiccups, the benefits far outweigh these minor drawbacks. The time and stress saved, coupled with the potential for maximizing tax deductions and gaining real-time financial insights, make Kick a game-changer for businesses of all sizes.

In a world where time is the most precious commodity, Kick gives you back hours in your day and peace of mind in your financial management. It’s not just about keeping your books in order; it’s about empowering you to make smarter, data-driven decisions that can propel your business forward.

So, if you’re ready to put your bookkeeping on autopilot and take your financial management to the next level, it’s time to give Kick a spin. After all, in the race of business, why drive manually when you can kick it into high gear?

common FAQs with answers:

Is Kick suitable for small businesses and startups?

Absolutely! Kick is designed to scale with your business, making it perfect for startups and small businesses looking for professional-grade financial management without the complexity or high costs.

How accurate is Kick’s AI in categorizing transactions?

Kick’s AI is highly accurate, thanks to its advanced algorithms and human expert review. However, it’s always a good idea to review categorizations regularly and set up custom rules for unique transactions.

Can Kick integrate with other business tools I use?

While specific integration information isn’t provided on the website, many modern financial tools offer API connections. It’s best to check with Kick’s support team for the most up-to-date integration capabilities.

Is my financial data secure with Kick?

Kick takes data security seriously. While specific security measures aren’t detailed on the website, it’s standard for financial software to use bank-level encryption and security protocols. For more details, you should check their privacy policy or contact their support team.

How does Kick compare to traditional bookkeeping software like QuickBooks?

Kick differentiates itself with its AI-driven approach, offering more automation in categorization and deduction tracking. It’s designed to be more user-friendly and require less manual input than traditional software. However, the best choice depends on your specific business needs and comfort with AI-assisted tools.

- Automated transaction categorization saves time and reduces errors

- AI-powered deduction tracking maximizes tax savings

- Real-time financial insights aid in better decision-making

- Unlimited entity management at no extra cost

- Accountant-friendly features facilitate seamless collaboration

- Custom rule creation allows for personalized bookkeeping

- User-friendly interface makes financial management accessible to non-experts

- Continuous learning and adaptation to your business patterns

- Pricing details not readily available on the website

- It may require an initial learning curve to set up custom rules effectively

- Automated systems may occasionally miscategorize unique transactions

- Dependence on AI might reduce hands-on understanding of financial processes for some users

- Limited information on integration with other business tools or software

Check Similar Tools